FAIR-WEATHER SAILORS … RESIDENTIAL RENTAL INVESTORS

Any Connection?

The proverbial “fair-weather sailors” never venture from port unless all conditions are perfect or nearly so … wind, currents, blue skies and sunshine. That said, it’s easy to believe their maritime successes are unremarkable.

Now to residential rental investors who share the excessive caution of the above-described seafarers … and ignore that in the midst of every crisis, lies great opportunity. The crises: Inflation, Interest Rates and Recession.

So, in this issue I’ll present two scenarios to profitably navigate the shoals of what is likely to be a challenging residential investor voyage into 2023 and beyond. (That’s the last of my nautical metaphors for this article.)

As ever, I won’t burden you with a ton of documentation … just a summary of my expectations and intended actions based on my research and experience.

Let’s start with a bit of background on the three main crises drivers that will influence success for residential landlords in the face of less-than-ideal financial circumstances.

Inflation

The most recent CPI report asserts inflation rose 7.7 percent in October … year-over-year … less than September’s 8.2% and less than what experts predicted. On a monthly basis, price gains climbed by 0.4 percent between September and October, matching the previous month.

So, while the October CPI data is reassuring, we’re facing a long haul to dig our way out of runaway inflation. A single month of better news is not sufficient to believe we’re out of the woods.

Richmond Federal Reserve Bank President Tom Barkin made clear that the board isn’t going to relent. In a speech to the Top of Virginia Chamber of Commerce, he said “…. the economy should get into better balance in the months to come, but I expect that process to be a lengthy one, as these artificial pressures take time to settle, and geopolitical risks continue ...”

There remain significant risks that could keep inflation elevated … specifically non-housing services … such as airfares, childcare, health care and recreation. Those and many others are closely tied to wage increases which have been escalating at a fast pace in recent months.

The most recent jobs report was strong. That’s the good news. The less than good news is that low unemployment may keep inflation high as employers compete financially to attract workers from a truncated pool of qualified candidates. Wage inflation can trigger a wage-price spiral that intensifies the problem.

Adding to the potential for extended inflationary pressures, a number of major companies have recently reported rising third-quarter sales and profits … largely credited to hefty price increases. Many executives said that they would continue raising prices, partly to cover rising costs and partly to expand their profit margins … noting that consumers often appeared willing to pay more for the same goods and services.

All in all, I agree with the consensus among many economists and financial experts … higher prices will extend well into next year, and it’s not unlikely to extend into 2024.

Interest Rates

Predictions for continued inflation deliver a clear signal that the Fed will continue to keep its foot on the interest rate accelerator. I predicted, and the Fed confirmed, a 75-basis point bump early this month … best guess is another 50-point jump by year-end, followed by further increases in the upcoming year.

Since Q1 of this year, the Fed has rapidly raised rates from virtually zero to a range of 3.75% to 4% today. Objective: Cool the economy and bring down inflation from near 40-year heights. How high will the Fed hike interest rates? No way to know for sure, but there are experts who are not ruling out a terminal rate of 6% or more … the highest level targeted since 2001.

The latest 75-basis point hike escalates 30-year fixed-rate mortgages to 7+ percent. That more than doubles the rate from a year ago … and my expectation is that Fed rate increases later this year and in 2023 will push the market further into the 7+ range or higher.

Residential rental investors’ opportunity #1: Inflation raises mortgage rates. For landlords positioned to invest now, the opportunity is to negotiate reduced purchase prices to compensate for the increased cost of borrowing.

Recession

Recession is a benchmark that inflation has maxed out. Historically, that means interest rates will begin to drop … probably gradually, not likely a nosedive. As inflation peaks, recessionary pressures will further reduce interest rates.

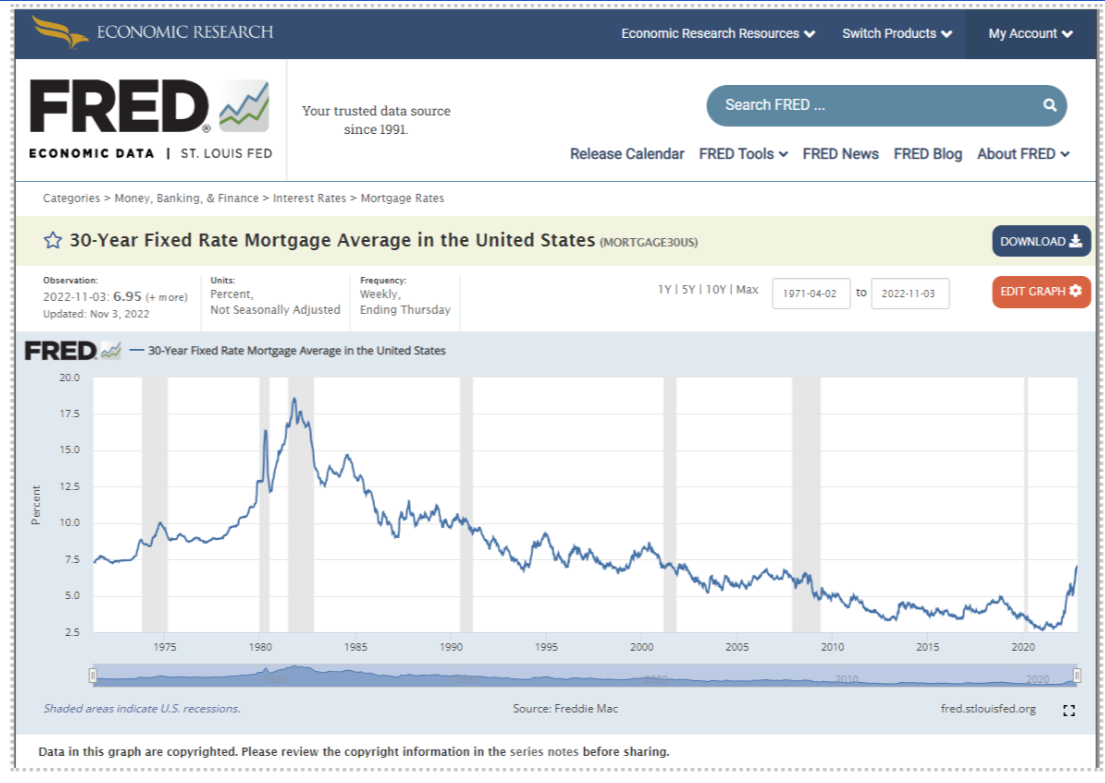

Click here or on the following interactive chart. Notice the spikes in rates that precede recessions … followed by downward trends as documented over three decades of history.

Residential rental investors’ opportunity #2: For landlords positioned to invest now, the opportunity is to buy at reduced prices … in anticipation of refinancing at a lower rate. That means buy your rental asset “on sale” … and buy reduced financing as it comes “on sale”.

A few examples of the payoffs:

Buying a property valued at $200,000 for something less … say $180,000 … which adds $20,000 to your portfolio balance sheet.

Refinancing at a lower rate to increase your cash flow by lowering your debt service payments.

Cash-out refinancing at a lower rate to free up capital for additional investment.

Refinancing to a shorter mortgage term to build equity faster.

As ever, I invite your comments!

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and

relieve your stress by evaluating your property management options.