We're not gamblers, you and I, ... but we are risk-takers who

need to know how to minimize exposure and maximize wealth creation.

(First in a Series of 2 Articles)

In this piece, we’ll address the foundation elements of wealth creation … Renters and Rents. Next issue we’ll tie it all together with an eye to residential rental market Predictability and the likely payoff of a significant long-term Bonus.

Renters

Would-Be Homebuyers: Renting remains the option as homeownership remains out of reach for many would-be buyers. Mortgage rates hover around 7% and home prices remain high … making home ownership a distant dream for first-time buyers. That forces potential homebuyers into the rental market, contributing to high demand for apartments.

Additionally, many potential homebuyers are hesitant to make big purchases for fear of economic uncertainty. That means maintaining as tenants as they wait for more stability and positive economic forecasts.

Seniors: seniors represent an expanding tenant market … a group that chooses renting far more than in years past. Recent U.S. Census data reports the number of renters aged 65 and over increased by 2.4 million … a 30% bump in just ten years.

Motivations to rent include:

- The burdens of home ownership – property taxes, repairs, etc.

- Moves to be closer to family

- Budget savings

- Job-related moves, seasonal residences, part-time relocation.

Interestingly, renting single-family homes by the 65 and over group surged by 25% in 2023 … and the expectation is that trend is likely to continue. Apparently, the appeal is privacy without the upkeep and maintenance responsibilities plus extra space for hobbies and visiting family and friends.

About 69.1% of Virginia household owned their home in 2023 … about 2 in 3 … while the remainder rented. Other than a spike in early 2000, that percentage remained stabilized since 1984.

Bottom line … no anticipated change in the roughly 30+% of Central Virginia households that are renters. So, the tenant base will continue to support the need for residential rental housing.

Additionally, there are economic developments that will affect the potential for short-term increases in rents and long-term wealth creation. And that introduces the next topic … Rents.

Rents

The two main drivers to determine rent are:

- Enjoy positive cash flow

- Appeal to quality renters with ability and willingness to pay.

Positive Cash Flow: Simply put, the operative equation is to subtract unnecessary expenses, shop for the best solutions to satisfy necessary costs and price for a profit margin. Today, two of the main expense challenges are real estate taxes and insurance.

Real Estate Taxes: History has shown Central Virginia's commercial residential real estate values have generally risen over time, driven by consistent demand and a strong economy. And assessed property valuation is the determining factor of taxes. As property values accelerate, so does the tax bite. Recent years have seen significant increases in property values in Central Virginia, particularly for multifamily properties. Result … higher tax bills.

Insurance: Homeowners’ insurance has soared in Virginia … an astounding 31% bump since 2021! Several factors have driven up premiums according to the Consumer Federation of America: natural disasters, labor and material costs, reinsurance rates and lax regulatory oversight.

So, the above significant expenses, coupled with rising maintenance, repair and replacement costs, must be addressed in pricing that yields satisfactory benefits to tenants and positive cash flow for you and me. The solution … attract quality tenants who have the willingness and ability to pay what we need to charge. There are 3 developments that support the fact that just such a renter population is increasingly able to accept rent increases …

Wage Inflation, Real Blue Collar Wage Growth, Low Unemployment

Wage Inflation

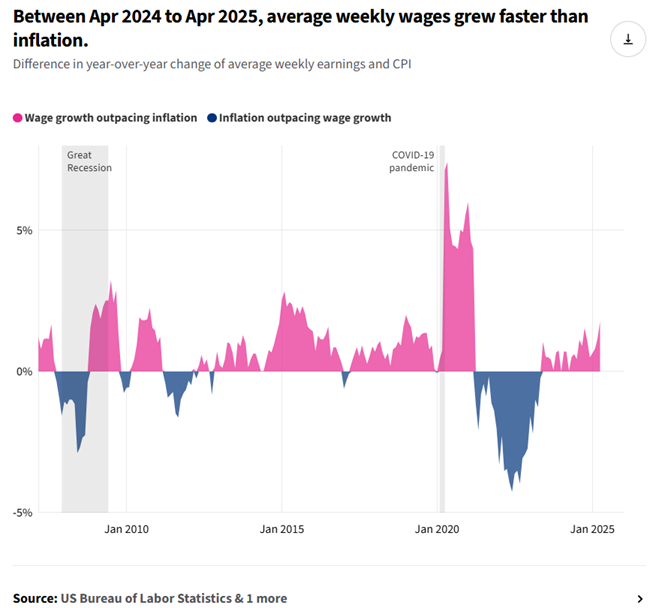

When wage growth outpaces inflation, it indicates that workers enjoy an increase in purchasing power from the previous year. The U.S. Bureau of Labor Statistics reports that since March 2006, average wages outpaced inflation 71.6% of the time. Most recently, wage growth exceeded inflation every month since February 2024. For the 12 months April 2024 to April 2025 wages grew 1.8 percent faster than inflation … 4.1% vs. 2.3% respectively.

Blue Collar Wage Growth

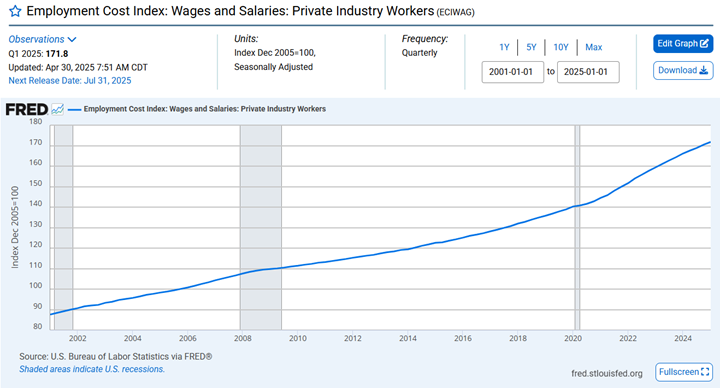

Blue-collar workers enjoyed real wage growth of almost two percent in the first five months of this year … the largest increase in nearly 60 years. Falling inflation has driven the significant improvement in blue-collar wages, lifting workers’ take-home pay and living standards by 1.7% so far in 2025.

This trend in wage growth is generally shared across the board by U.S. Private Industry Workers.

Click here for interactive access to the following graph.

Low Unemployment

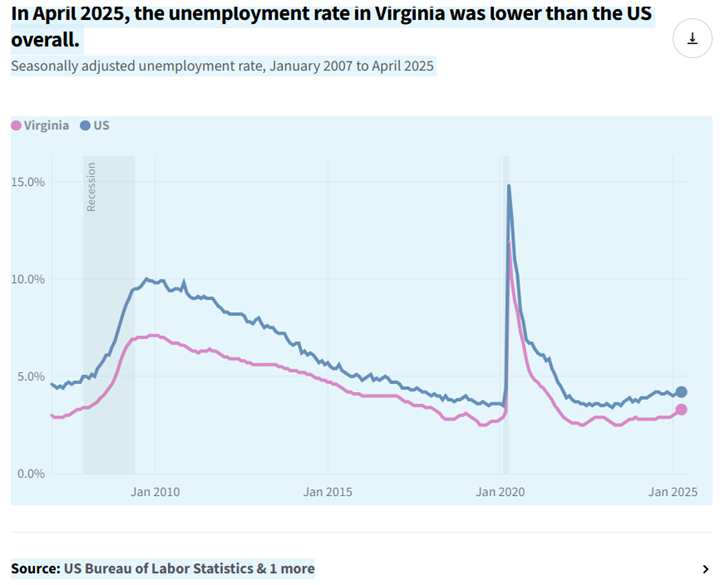

Virginia unemployment rate continues to maintain numbers that are historically low. There was a slight increase of 0.5% from April 2024 to April 2025 … yet notably remaining significantly below past rates.

Don’t hesitate to charge what you must … quality renters are out there

with sufficient means to meet your requirements.

Be sure to join us in our next issue when we tie it all together with an eye to residential rental market Predictability and the likely payoff of a significant long-term Bonus.

Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.