The passage of the Tax Cuts and Jobs Act (TCJA) delivered significant tax savings benefits for many businesses. In this issue we’ll spotlight a significant expanded provision that positively impacts depreciation and expensing for nearly every business … including residential real estate investors. That provision is Bonus Depreciation which allows accelerated tax write-offs for qualifying property improvements. Important: The 100% tax saving benefits of Bonus Depreciation expires at the end of 2022.

Bonus depreciation revisions likely will affect your strategies to maximize benefits for your residential rental property investments. Our objective is to summarize the new provisions, as we understand them, and prompt you to seek guidance from your tax advisor to determine the specifics as it pertains to your unique circumstances.

Powerful Taxable Income Reduction Opportunity

Bonus Depreciation for residential landlords presents a powerful tool for you as an investor to profoundly reduce your taxable income. Here’s a general rundown.

- Bonus depreciation applies to both new and used property improvement items.

- Bonus depreciation percentage boosted from 50 percent to 100 percent for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

- Bonus depreciation in real estate allows an investor to deduct the full cost of capital improvements in the same tax year the expense is incurred.

- The maximum inflation adjusted deduction for 2022 is $1,080,000.

- To qualify for bonus depreciation, an improvement must have a useful life of 20 years or less and must be purchased from an individual or entity that a taxpayer is not related to.

Important Note: Bonus depreciation in real estate applies only to improvements and not to a rental property deemed to have a useful life of more than 20 years.

- Generally, machinery, equipment, computers, appliances and furniture will qualify.

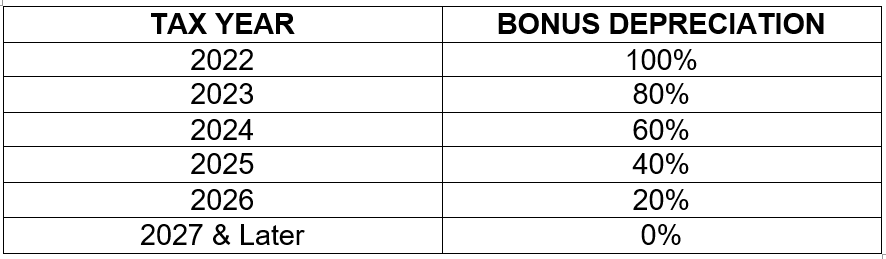

- Bonus depreciation currently is 100% through December 31, 2022. After that date, it is scheduled to be gradually phased out by the end of the 2026 tax year.

TAX YEAR | BONUS DEPRECIATION |

2022 | 100% |

2023 | 80% |

2024 | 60% |

2025 | 40% |

2026 | 20% |

2027 & Later | 0% |

The chart illustrates the need for investors to embrace a sense of urgency to maximize tax savings. Invest in as many 100% tax deductible improvements that you can afford … this year!

In a nutshell, bonus depreciation delivers far more tax savings benefits than either straight-line or declining-balance depreciation methods for property improvements … both of which stretch out depreciation deductions over a period of years. In contrast, bonus depreciation allows a taxpayer to immediately deduct 100% of the cost of a qualifying improvement in the first year of its use. That means improvement expenses are treated the same as repair and maintenance expenses … deductible in the tax year incurred.

Dramatic Bonus Depreciation Windfall for Investors

Here’s how bonus depreciation works for a typical single-family home rental investor client of KRS Holdings.

The home is valued at $220,000 exclusive of the lot value. Annual rental income yields a total of $28,000. Operating expenses are $11,200, not including mortgage payments. That results in pre-tax income to our investor of $16,800 ($28,000 minus $11,200).

Residential real estate properties are generally depreciated over 27½ years. So at a value of $220,000, the depreciation expense for our rental unit is $8,000.

Our client/investor chooses to invest $20,000 in new kitchen appliances and carpeting … the total cost qualifies for the bonus deprecation deduction this year. Here’s how the math works to deliver a taxable income of zero.

In contrast, typically appliances and carpeting are depreciated over 5 years … or just $4,000 in the year of our example. Bonus depreciation at 100% elevates the deduction to $20,000. Net result … taxable income at zero compared to $4,800 under the “old rules”.

Action Item

There are 9 months or less (depending on when you are reading this) to enjoy the benefits of 100% bonus depreciation tax deductions. Don’t wait! Consult with your tax advisor and property manager for guidance in whether investments in bonus depreciation improvements are right for you. In addition to immediate tax-relief, property improvements may offer opportunities for you to raise monthly rents … plus be more selective in your choice of qualified tenants to avoid the two major rental property thieves – turnover and vacancy.

At KRS Holdings, we stand by our core principles: Successful property management

is based on simple math: Add value to your assets, subtract unnecessary expenses.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.