(Second in a Series of Two Articles)

Click here for a first-time or refresher read of the first article.

In planning for the upcoming year, I rely on my interpretation of the importance of 5 Indicators.

- Fed Actions

- Rent Growth

- Wage Inflation

- Employment Statistics

- New Residential Rentals

In the first issue of this 2-part series, I introduced the above 5 Indicators as a potential guide for your planning in 2024 … and detailed the first three, Fed Actions, Rent Growth and Wage Inflation. As promised, in this issue, we’ll cover 4 and 5 above. The significance is in the trends … always with the caution that past performance is no guarantee of future results.

Employment Statistics

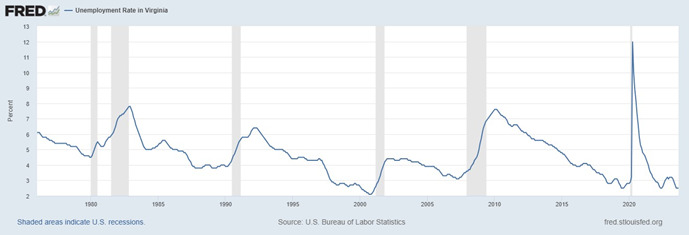

Unemployment at or Near Historical Lows

Virginia ranks an admirable number 10 of the 50 states in registering the lowest unemployment rates … 2.5% in July 2023 vs. U.S. unemployment at 3.8%. Click here for the interactive graph.

Additionally, people are staying on unemployment for shorter times. That, coupled with a Viginia labor force participation rate of 66.8%, means jobs are available for all who choose to work.

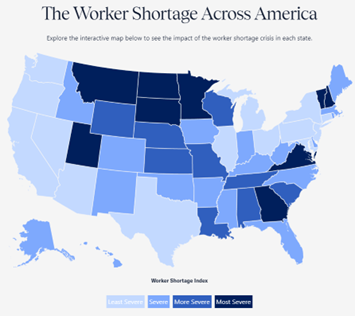

The Virginia Worker Shortage Index reports in September there are 47 available workers for every 100 open jobs. That has remained between 47 and 55 since January of this year and indicates:

- There’s a sizeable upside potential for job growth in the Commonwealth.

- Labor participation will grow as the economy continues to expand.

- Wages will continue to rise as employers compete for quality workers.

Note: Consider these statistics in the context of Wage Inflation. For example, if an employer has 100 job openings and 100 workers show up to apply … there is considerably less pressure to compete with wage incentives than if only 50 workers applied. In the first instance, workers are competing for a job. In the second, the employer is competing to attract the best employees from a smaller pool.

Click here to visit the U.S. Chamber of Commerce interactive state map.

New Residential Rentals – Virginia

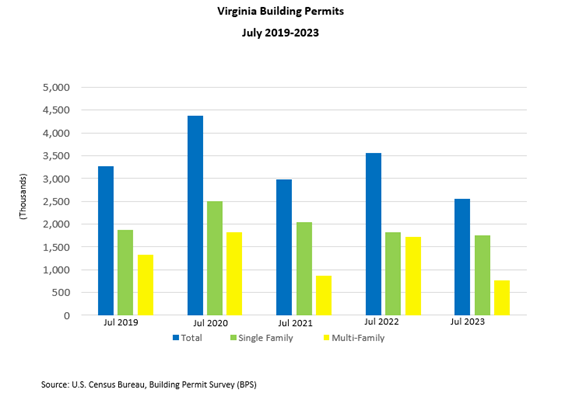

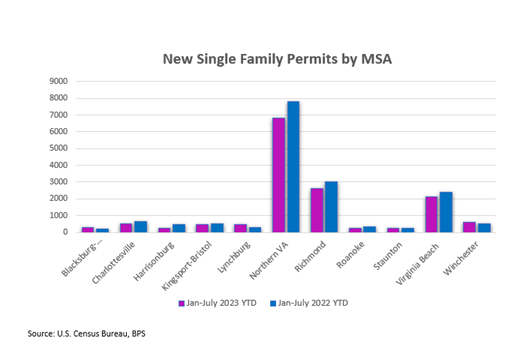

Single Family Homes: Mid-year permits in Virginia for single-family homes were 2.9% less than the same time last year. Permits for single-family homes dropped the most in the bigger metro areas such as Richmond (-12.8%) and Virginia Beach (-11.6%). Although we are seeing some growth in new construction in smaller areas of the state, it is not enough to meet the present level of demand in the market.

The lack of supply will continue to put upward pressure on housing prices as mortgage rates continue to surge above seven percent. That means an expanded pool of renters as potential home buyers are priced out of the market.

Virginia's Built-to-Rent Housing Boom: In Virginia, there are over 1,000 built-to-rent homes planned or under construction. These are single-family houses constructed as rental properties. There is growing demand from would-be home buyers who can’t afford or choose not to buy a new home. The advantages of a single-family residence are coupled with professional property management and no need for a down payment or long-term commitment.

Note: Zoom reports Metro Richmond needs around 15,000 new homes to meet current demand.

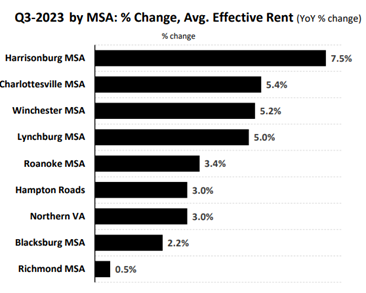

Multifamily Rentals: As with single-family homes, the pace of growth in Virginia’s multifamily market has slowed. Rents are tracking upward, but less than the rate of growth experienced a year ago.

Demand for multi-family units remained strong statewide with 3,917 units absorbed in Q3 2023. Northern Virginia had a total of 1,845 multifamily units absorbed this quarter, due in large part to midrise/high rise apartments. Blacksburg was the only metro market in Virginia to have negative absorption with a net decrease of eight multifamily units.

Affordability constraints in the for-sale housing market will likely keep many would-be homebuyers renting for longer. This should keep demand robust in the multifamily rental market in the near term.

Admittedly, there are “wild card” factors that may affect the economy in upcoming months … the 2024 elections; Fed moves; geopolitical developments, recession pressures, etc. That said, I’m of the opinion that wage inflation, job growth and single-family home prices will continue to expand this year and into the next.

So, how is wage inflation, rising employment and home purchases beyond the reach of potential buyers likely to affect residential landlords like you and me? I’m convinced there will be robust gains in employment, wages and spending power in 2024. The net effect for residential rental investors will be an expanded tenant pool of workers enjoying sizable bumps in income. In turn we will enjoy enhancements in rental income, tenant quality and appreciation in asset values.

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and relieve your stress by evaluating your property management options.