Your rental property is a business!

This may not be the most profound statement you have heard all day, but it is nevertheless critical to your success as a residential rental property owner. And that means you must be vigilant to manage your business in the pursuit of cash-on-cash return plus increased asset value of your investment. As a business, your “inventory” is floor space. You sell it via rent payments. The balancing act is to periodically determine rents that are fair to both tenants and to you – the investor. In this article, I offer a checklist for success in evaluating the factors to be considered. Notably, your rental pricing considerations and analysis are essentially the same in deciding a first-year rent as well as increases over time.

This may not be the most profound statement you have heard all day, but it is nevertheless critical to your success as a residential rental property owner. And that means you must be vigilant to manage your business in the pursuit of cash-on-cash return plus increased asset value of your investment. As a business, your “inventory” is floor space. You sell it via rent payments. The balancing act is to periodically determine rents that are fair to both tenants and to you – the investor. In this article, I offer a checklist for success in evaluating the factors to be considered. Notably, your rental pricing considerations and analysis are essentially the same in deciding a first-year rent as well as increases over time.

Do Your Homework

Evaluate the current rental market in your area. You can research rental comps and trends through a variety of resources. Here are three to get started. You’ll discover others. • Rent-o-Meter • Bureau of Labor Statistics • Craig's List

Evaluate Your Research

Some questions to ask: • What are current vacancy rates and demand for rental units? • How do your current rents compare to similar properties? • If your rents are generally higher, does your property include amenities that justify the difference?

Seasonal Trends and Pricing Strategies

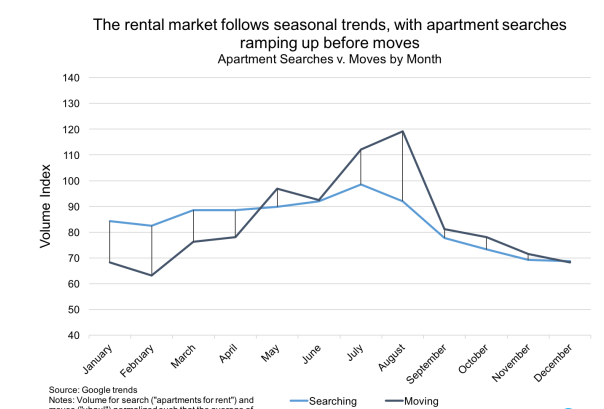

The law of supply and demand was not formulated based on residential real estate. That said it is very much a reality when it comes to pricing of rental units … whether in multi-family residences or single-family homes. Renters drive the demand side of the equation. Landlords create the supply. Seasonally each of these elements is affected and here’s why. Renters’ seasonal moving preference is summer. That time of year for moves is motivated by three practical considerations: • The kids are out of school. That means an incentive to avoid switching schools or school districts mid-academic year. • Weather is often a factor. Depending on the location, inclement weather may result in cancellations or delays of moves. That’s true in areas with severe climates but also has an impact in locations with less extreme weather … for example a rainy season. • Job changes are frequent in the fall of the year. If the new job requires a move, doing so before the start date is imperative. In contrast, the final quarter of the year has as its hallmark the fewest moves. In addition to the reasons listed above, that time of year tends to distract most of us with the expenses of getting kids back to school plus the anticipated financial and time commitments of the upcoming holiday season. So tenants exhibit seasonal trends in both their search for rentals as well as the physical move. Here’s a graphic representation of both these activities.  As presented above, searches begin to accelerate following the Holidays and reach their crescendo in July. Somewhat in predictable lockstep, moves begin to increase in early spring and fast-track to their peak in August. Alert Landlords understand this seasonal fluctuation in demand on the part of prospective tenants. Since it is a historical fact of life, residential rental investors need to recognize this phenomenon and formulate marketing and pricing strategies to successfully respond to the seasonal preferences of renters. Dictated by the law of supply and demand, rent prices tend to decrease as demand softens in the last quarter of the year. As a landlord, you may choose to make special offers regarding security deposits, upgrades, or monthly rent. Tip to Landlords: When making concessions to attract renters in the “off-season”, it pays to consider aligning the lease expiry date to get back on track with an annual lease that corresponds to peak moving months. For example, a new tenant in November may be presented with a lease that is up in April. Note: Rental units in a growth market may not be subject to as broad swings in pricing as those in a more stable community. Growth markets usually are accompanied by increased housing demand as residents flock to an area with more to offer in jobs and quality of lifestyle.

As presented above, searches begin to accelerate following the Holidays and reach their crescendo in July. Somewhat in predictable lockstep, moves begin to increase in early spring and fast-track to their peak in August. Alert Landlords understand this seasonal fluctuation in demand on the part of prospective tenants. Since it is a historical fact of life, residential rental investors need to recognize this phenomenon and formulate marketing and pricing strategies to successfully respond to the seasonal preferences of renters. Dictated by the law of supply and demand, rent prices tend to decrease as demand softens in the last quarter of the year. As a landlord, you may choose to make special offers regarding security deposits, upgrades, or monthly rent. Tip to Landlords: When making concessions to attract renters in the “off-season”, it pays to consider aligning the lease expiry date to get back on track with an annual lease that corresponds to peak moving months. For example, a new tenant in November may be presented with a lease that is up in April. Note: Rental units in a growth market may not be subject to as broad swings in pricing as those in a more stable community. Growth markets usually are accompanied by increased housing demand as residents flock to an area with more to offer in jobs and quality of lifestyle.

RAISE THE ROOF … definition: to make a lot of noise by playing music, celebrating, shouting, etc. The crowd raised the roof when the winning goal was scored. : Your tenant(s) raised the roof when you raised the rent.

Practical Rent Increase Considerations

If your research points to initiating a rent increase, some tenant considerations for you to think about. • Moving is stressful and costly. Unless the rent increase is north of the market, tenants are likely to avoid relocating. • Should you consider a raise in rents on only certain units based on current demand, e.g. one-bedroom vs. two bedrooms? • Will you exclude “high-value” tenants from a rent increase to avoid the risk of losing them? • Will you offer “tenant appreciation spiffs”, e.g. carpet cleaning, or an upgrade to the unit? Take away the “surprise” factor of rent increases. Regular, modest raises in rent are more easily digested by tenants than one massive increase after none for over a year or longer. Note that you also have options that allow you to increase your income without raising rent. Most people are aware that cost of living increases are a fact of life. As discussed above, Do Your Homework.

Get Ahead of the Issue with Your Lease Agreement

Remember … your rental property is a business! Increases in rent over time are essential for you, the landlord, to keep pace with inflation as well as upturns in maintenance, utilities and other operating costs. Without that option, your business is likely to become a losing proposition. Your lease agreement must include a rent escalation clause that will specify how often and by how much rents may be raised. Rent escalation clauses may address increases as a percentage of increase to the rent and may be tied to increased operating costs. For example, the planned increases may be expressed as a maximum percentage of the prior rent at renewal … let’s say a maximum of 4 percent. Alternatively, the lease renewal rent may be based on a variable percentage increase based on the Consumer Price Index (CPI). Take a look at this article published by the U.S. Bureau of Labor that addresses that approach. The clause may also specify an increase based on an uptick in your costs for such things as: • Property improvements • Increased property taxes • Higher utility costs • Increased repair and maintenance costs • Planned capital improvements

Bottom-Line!

You don’t want to go through the ordeal of raising rent. And your tenants will not be overjoyed at the news. However, it’s a necessary reality of property management. You need to deliver value to your tenants while realizing a fair return on your asset … both in positive cash flow and appreciation of your property.