(First of 3 Articles)

- Inflation Stabilized

- Inflation + Interest Rates ... Leverage, Synergy, Profits

- What Does Inflation at 2% Mean?

Myopia: When close-up objects look clear but distant objects are blurry.

When it comes to investing, perception has a profound impact on our decision-making. Faulty perception leads to actions misaligned with reality. So, in this piece I offer my perception of the U.S. economy as it relates to all of us as residential real estate investors. Objective: Avoid fuzzy vision of current economic triggers.

Q1 2024 Recap

The March reports came out with some pundits preaching doom and gloom. While all is not perfect (whatever that is!), focusing on only some of the stats can be a function of investor myopia. Specifically, two ‘I’ words (no pun intended) take center stage for many residential rental investors and landlords ... interest and inflation ... to the exclusion of other key decision-making indicators.

We’ll deal with the specifics and relationship of the two ‘Is’ in Article 2 of this series ... for now we’ll view the current reality of America’s rate of inflation.

Meanwhile a quick recap of what the March reports reveal as presented by the U.S. Department of Commerce in the article entitled ... By the Numbers: Continuing to Outpace Expectations ... U.S. Economy Gains

- Job creation in March exceeded expectations, with 303,000 jobs added to the U.S. economy.

- Both real gross domestic product (GDP) and personal income increased in all 50 states and the District of Columbia in the fourth quarter of 2023.

- Wage inflation continues to rise ... over the past 12 months, average hourly earnings increased by 4.1 percent.

Inflation on Hold

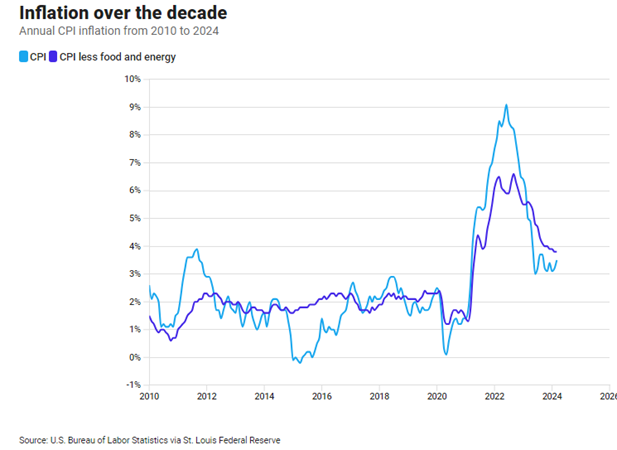

On the topic of inflation, the annual inflation rate for the United States was 3.5% for the 12 months ending March, compared to the previous rate of 3.2%, according to U.S. Labor Department data published on April 10, 2024. As the visual below indicates, while inflation is above the Feds benchmark of 2% it has notably demonstrated little volatility in recent months ... i.e. essentially stabilized.

The Fed’s Assessment

Federal Reserve Chairman Jerome Powell acknowledged that progress in reducing inflation has stalled since the start of 2024. That has come hand-in-hand with stronger economic growth, enabling the central bank to hold interest rates at their current level for longer than previously expected, Powell said.

So, for planning purposes, we anticipate one or more rate cuts by year end. Other than that, with strong economic growth, a stabilized inflation rate, low unemployment and Powell’s statement about holding interest rates at their current level tells me that uncertainty for the balance of this year is minimal.

Takeaways

As I see it, the primary guiding principle for the balance of this year is ... there are no apparent headwinds.

- Federal Reserve Chairman indicated there will likely be no rate increases this year, confirmed a reduction in the number of cuts originally anticipated, and declared inflation at a standstill.

- American workers are enjoying “good times”. Virginia unemployment so far in 2024 matches the 3% experience of last year and remains way below the long-term average of 4.56%. That news is coupled with a boost in average hourly wages of 4.1%.

- All signs point to a continued healthy economy and GDP growth during 2024 and perhaps beyond.

As fellow investors/risk-takers, we abhor uncertainty. At least for the balance of this year all seems to be comfortably predictable.

Be sure to look for Article 2 in this series ... an eye-opener of how

inflation/interest rates synergy drives residential real estate wealth creation.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.