LANDLORDS AS BUSINESS OWNERS

Managing Your Business in Inflationary Times

(First in a Series of 2 Articles)

Your Residential Rental Real Estate is a Business

Your rental property portfolio … whether a single unit or many is a business! Treating it as a business is critical to your success as a residential rental property investor/owner.

And that means you must be vigilant to manage your business in the pursuit of short-term cash-on-cash return plus long-term asset appreciation. As a business owner, consider your “inventory” is floor space. You sell it via rent payments.

So, let’s take a look at the business landscape of a residential landlord in this period of exceptionally aggressive inflation.

- Pool of Tenants: During high inflationary times, mortgage rates accelerate creating a barrier to home ownership. Additionally, a recent article in Fortune magazine offers this assessment: Soaring costs for homes and increasingly severe debt burdens mean that one out of every three renters is completely priced out of the home-buying market, ….” Landlords benefit from a large and stable pool of quality renters.

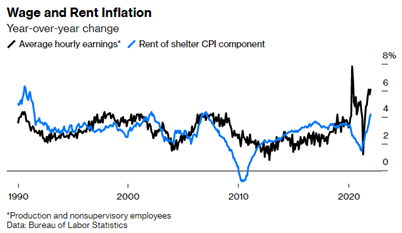

- Wage Inflation: As inflation drives the cost of goods and services up, wages follow suit … and so does the cost of rent. So as a property owner, you're able to increase rents in lockstep with inflation. Take a look at this history:

- Leverage: Landlords with mortgage interest rates less than inflation enjoy leverage. That means the borrower’s interest rate minus the rate of inflation equals the real interest rate. In the face of current and anticipated high inflation, the real interest rate is often a negative number. Certainly, Landlords should consider borrowing or refinancing to benefit from this phenomenon of financial leverage.

- Pay Back With Less Than Borrowed: Cash on hand today is worth more than inflated cash in the future, so borrowers pay lenders with money that is worth less than when the loan was originated.

- Rental Spread: Landlords enjoy inflation-stimulated spread between rising rental rates and loan servicing which remains level.

- Asset Value Growth: Asset value of the property will increase generally in-synch with inflation.

The Critical Objective … Create Positive Cash Flow

Your rental income is the lifeblood of your investment. The balancing act is to periodically determine rents that are fair to both tenants and to you – the investor. As the investor your objective is to generate positive cash flow after debt service, taxes, insurance and maintenance. In business terms … this is your net profit.

Here’s a quick example of a positive cash flow scenario enjoyed by a fictional landlord, P. Smith

- Smith owns three rental properties. Each rents for $1,000 per month.

- Monthly expenses for debt service, taxes, insurance, maintenance, and property management are 40% of gross rent receipts.

- Smith is cautious and sets aside 5% of rent receipts in a reserve account for unexpected expenses.

Smith’s monthly cash flow is:

- ($1,000 x 3 homes) $3,000

- Minus (40% x $3,000) $1,200

- Minus (5% x $3,000) $150

Positive Cash Flow $1,650 per month

Especially in these inflationary times, your focus must be to manage all elements that determine whether you will enjoy a positive monthly cash flow …. or, suffer an outflow of funds to cover insufficient net rental income. Certainly, you want to harness the power of positive cash flow. In simple terms, you want to bring in more money than you spend each month.

Positive cash flow creates opportunity to harvest profits from your investment property to reinvest and continue to grow your financial security. Extra monthly income is also a ready source of reserves to address life’s financial surprises.

Caution: Hope is not a strategy … don’t endure current negative cash flow in hope to make up for it

in long-term appreciation of your property. Current cash is king and delivers ready-funds for other investments or simply to enhance your immediate financial quality of life.

Note: Be sure to keep an eye out for the next article in this series. You’ll learn 5 proven tips to enhance your positive cash flow … and how to apply them to your unique residential rental business.

At KRS Holdings, we stand by our core principles: Successful property management is based on simple math: Add value to your assets, subtract unnecessary expenses.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management

options plus maximize your rental property positive cash flow.